Va Mortgage within the Illinois

Among various benefits available to the everyone which has actually served regarding armed forces, the fresh new Va financial was a genuine gem. The brand new Virtual assistant loan is actually a mortgage program having empowered many out-of residents regarding county out-of Illinois with the ability to purchase a home and you may secure an input its respective communities.

Particular Seasoned Pros

You’ll find a number of positives that come with the brand new Virtual assistant-guaranteed mortgage one differentiates they off their particular lenders.

There are a great number of advanced software accessible to assist Illinois citizens purchase a property which have a small downpayment. Although not, the fresh Virtual assistant financial doesn’t need any downpayment getting certified individuals.

This 1 big function makes it possible to pick a home inside Illinois and you can potentially save yourself several thousand dollars when compared to the 3% so you’re able to 5% advance payment requirement of other kinds of loans.

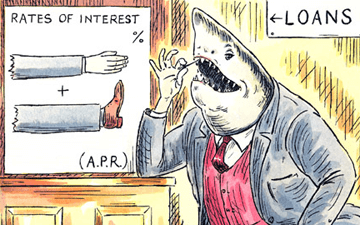

Very finance that enable homebuyers to find a property with a down-payment out-of below 20% of one’s price tag often fees a month-to-month superior labeled as Individual Home loan Insurance policies or PMI. Which premium is designed to include the lender should your resident is unable to make all the costs to the home loan.

In contrast, new Va financial will not query Va homebuyers so you’re able to spend PMI. Whenever along with the no advance payment element, it is clear that qualified veterans can help to save a good amount of money utilizing the Virtual assistant loan choice to purchase a property.

Yet not, there was a financing payment that Va fees which is 2.3% the first occasion and a small high at 3.6% to have then spends. This percentage can be added to the loan matter and in specific things, certain pros could be exempt away from paying it loans in Aspen Park.

It is an enthusiastic understatement to state that there are numerous away from records doing work in to invest in a property. Eg, below are a few of your suppliers as well as their positions for the our home financing:

- Home loan company facilitate home buyers finish the software

- Appraiser product reviews our home and provides an industry-centered speed statement

- Home insurance representative brings an insurance coverage binder to afford family

- Label insurance agent feedback the new name & action of the property and offers a study

- Real estate professional support the newest debtor complete an official offer buying our home

- Closure agent assembles most of the data files to possess signatures

It is merely a partial selection of different anybody in it in home financing. To simply help the veteran, the us government metropolitan areas a limit into the amount of for each and every goods that can be energized.

The way to get An excellent Va Mortgage during the Illinois: Eligibility

Each kind off financial keeps a couple of guidelines one dictate who can be eligible for the mortgage. The fresh Veteran’s Management manages these tips, but it does perhaps not provide currency directly to the brand new consumers. Alternatively, they approves finance companies, borrowing unions, and lenders to own Va home loan.

The fresh Veteran’s Government have different criteria towards the duration of service based on wartime or peacetime. At the same time, people with offered from the Reserves and you can/otherwise National Guard are qualified to receive a great Va financial. Here is a brief report about this service membership requirements.

- Have to have served at the very least ninety consecutive months through the a declared conflict

- Need offered no less than 181 straight weeks throughout peacetime

- Have to have supported at least 2,548 straight weeks (six years) sometimes on the Supplies or Federal Protect

- When your lover died at the time of the military solution, you’re qualified because the a thriving lover