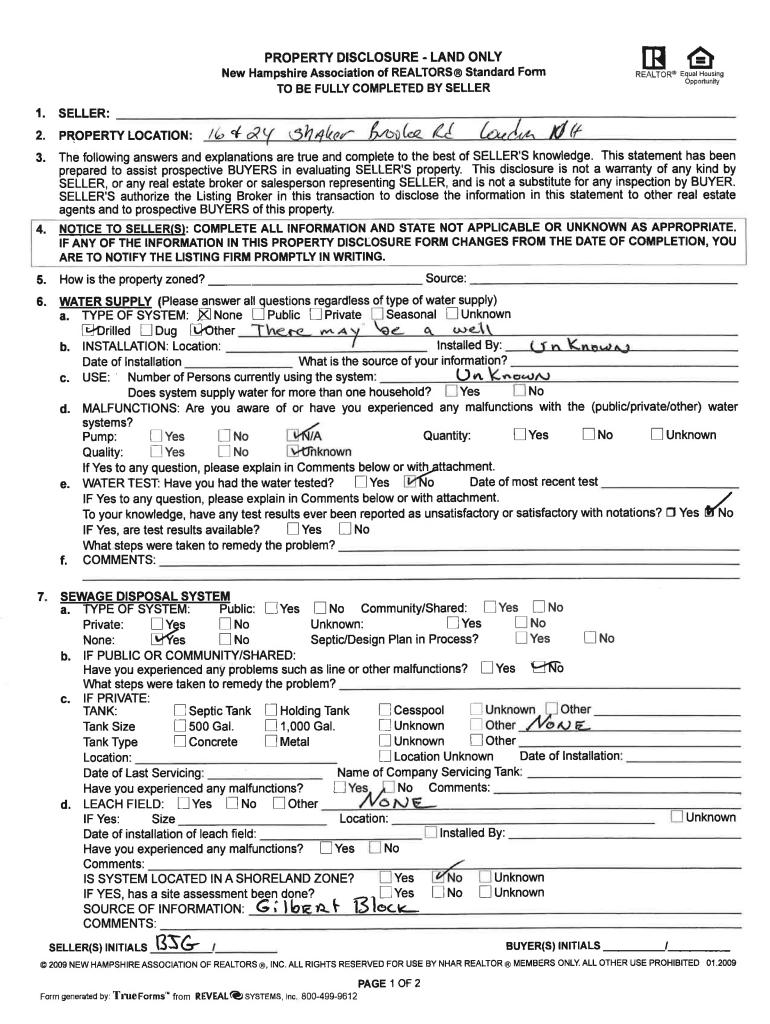

Observe how far you happen to be able to use out of your house. Only go into some basic information in our house equity finance calculator to determine.

- What exactly is a home collateral loan and just how can it work?

- Pros and cons off domestic equity loans?

- How to attract family collateral

- Very first uses for home equity loans

- HELOCs vs. home collateral fund

- Ideas on how to sign up for a property guarantee loan

What exactly is a property security loan and exactly how does it work?

Property equity mortgage is a type of loan that makes use of your property since the equity in order to secure the loans. It is one of two style of family equity-associated investment steps, others are house guarantee credit lines (HELOCs).

House security fund are similar to unsecured loans where the new bank facts your a lump-share fee while repay the loan inside repaired monthly premiums. A good HELOC operates much like a credit card because you borrow funds on the a towards-requisite basis. HELOCs come with mark periods that usually last ten years. During this period, you need to use funds from the credit range, and you are simply responsible for making focus repayments.

Both options need you to features a certain amount of home equity; here is the portion of the family you truly individual. Lenders usually need you to provides between 15 % and you can 20 percent guarantee of your home in order to remove loans in Marbury an effective house guarantee loan or line of credit.

That disadvantage would be the fact domestic equity funds and you can personal lines of credit has closing costs and you will fees just like an elementary home loan. Closing costs are very different, but may find the fresh new several thousand dollars based on the value of a home.

Just how to determine home collateral

You can estimate your possession share on your own. You may need one or two numbers: the newest reasonable ount remaining to repay on your own mortgage.

Assume your house’s latest worth are $410,000, along with a good $220,000 balance left on the home loan. Deduct the latest $220,000 the balance in the $410,000 value. Your computation manage appear to be this:

Just after figuring their equity risk, you can use our house guarantee calculator to determine just how much money your elizabeth to possess a house security line of credit with this HELOC Benefits Calculator.

Do you know the conditions to help you be eligible for property equity mortgage

Standards for family collateral funds are very different with respect to the bank and the loan terms. Usually, even if, individuals need to meet the pursuing the conditions and also have:

- Possess a house equity share with a minimum of 20%, however some loan providers enable it to be 15 per cent

- An obligations-to-money proportion away from 43 percent otherwise shorter

- A credit rating in the mid-600s or even more

Simple tips to submit an application for a house collateral loan

To apply for a property collateral mortgage, start with checking your credit rating, calculating the level of guarantee you’ve got of your property and you will reviewing your money.

Next, research household collateral prices, minimal standards and you can charge away from several loan providers to decide if you are able to afford that loan. As well, ensure that the bank gives the form of domestic collateral product you would like – some merely bring family security finance and others provide simply HELOCs.

Then you definitely complete a lender application form. When you implement, the lending company often ask for private information such as your label, day regarding birth and you may Social Safety count. You to definitely, in addition to money, are all it takes to obtain a simple quotation on the financing speed. For individuals who just do it, you will be required to fill in income files, that could include taxation statements and pay stubs, and proof homeowners insurance.