- Provides achieved a top consumer get in our customer happiness survey

- Constantly considering desk-topping mortgage sale more some unit models

- Try fully included in the brand new Monetary Features Payment Scheme and you can Monetary Make Expert banking standards regime.

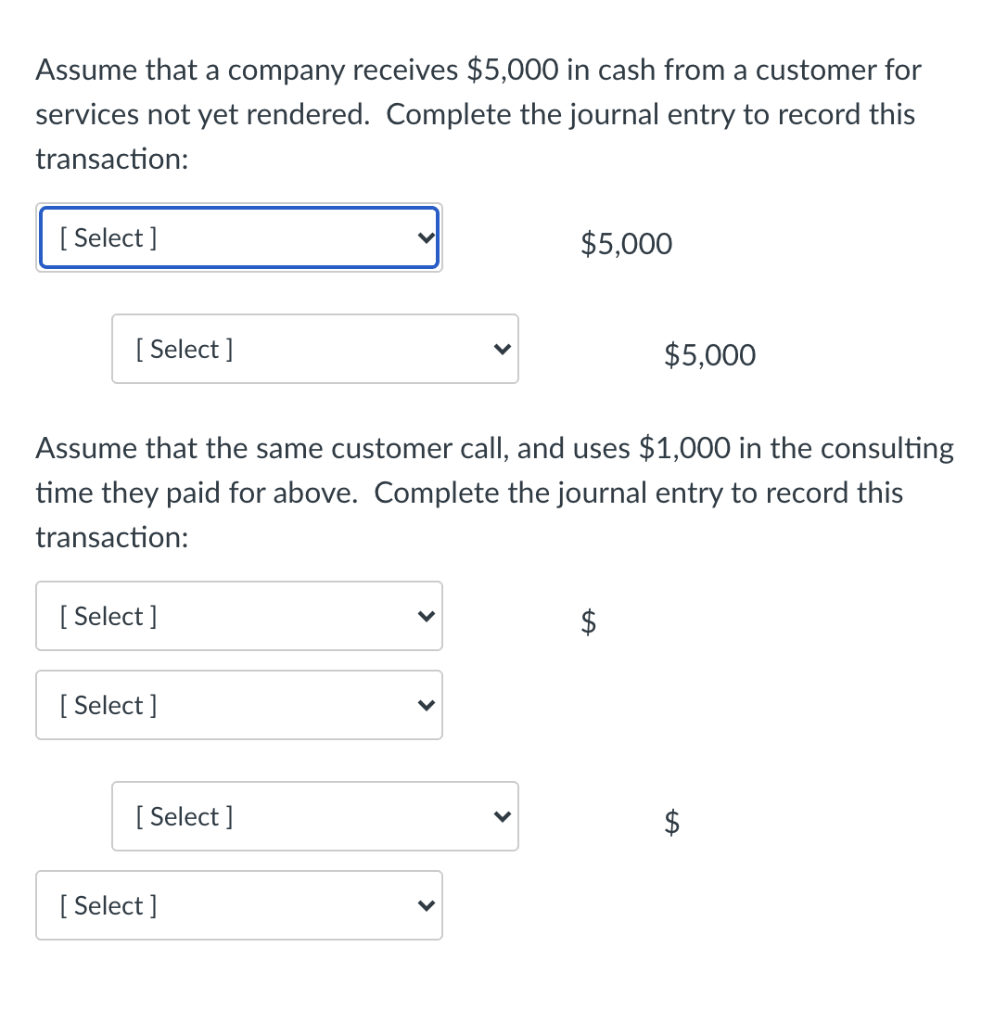

Mortgage loans can vary during the most means, definition it could be very problematic contrasting sales. Here are some tips to make it convenient.

Workout your own LTV

Furthermore, if you need to remortgage and your home is really worth ?five-hundred,000 while estimate you’ve got gathered ?100,000 in the guarantee, you need an 80% LTV home loan.

- Get the full story:just how much should i obtain to have a mortgage?

Discover a home loan type

Mortgage loans include categorised with regards to the ways their attention rates work, and more than people choose one of one’s following the a couple of financial products :

- Fixed-rate mortgages The pace continues to be the exact same to have a flat several months typically two otherwise 5 years.

- Tracker mortgages The pace is computed while the a specific fee over the Lender of The united kingdomt base rate getting a certain several months.

Examine rates

While researching mortgages, the rate the most techniques. It creates a significant difference to the month-to-month and yearly costs, while the our very own mortgage repayment calculator suggests.

Constantly, a lesser rate of interest can save you currency, but the size of the price also can affect the total price of a package.

Factor in home loan charges

Rates of interest are not the only topic you will have to think whenever evaluating mortgage product sales. Charges helps make a big difference, also, there are a handful of differing types you ought to look out for:

- Arrangement fees Commonly known as the reservation otherwise equipment charge, speaking of paid to your lender for creating your own home loan. They differ ranging from financial company, anywhere between free to ?twenty three,000. Particular loan providers costs a percentage of your own count you happen to be credit as an alternative than just a flat rate.

- Valuation charges Your lender will need to carry out a great valuation to see the property is really worth about what you need to pay for this. This is just to protect all of them, maybe not your, and lots of wouldn’t also show you the outcome, nonetheless they can occasionally still anticipate you to shell out the dough.

- Court charges These costs was recharged to work out the fresh new court details whenever setting-up another home loan or altering bargain.

In lieu of paying your financial charges initial, you may have the option of including these to the loan. This can be a useful option if you are low into the dollars, nevertheless will result in your paying interest on these charge throughout the years.

Check for early fees costs (ERCs)

For people who log off home financing within the introductory bargain several months, or pay off over the mortgage overpayment calculator maximum (always ten% per year), you happen to be recharged an early cost charges (ERC).

ERCs is just as much as 5% of your harmony in the first 12 months of your home loan, before losing every year after that.

The fresh new charges are usually charged into the repaired-speed mortgage loans of 5 years otherwise prolonged, as well as mean that if you decide to pay back the newest mortgage very early (in addition to of the swinging home and you can taking right out a new financial), you might have to pay thousands for the charge.

So if you believe you may want to circulate family inside the the following years, thought to play it safer by opting for a deal with no ERCs.

You could often prevent ERCs by getting a compact home loan 300 dollar 30 day loan , that you’ll take with you once you move house, however your own old mortgage may possibly not be the fresh most appropriate to suit your the latest possessions.