Introduction

Repair money are specialised lending products designed to help people into the financial support their residence improvement tactics. This type of loans are especially tailored to afford costs associated with remodeling, restorations, or updating a current assets. Regardless if you are think a primary family renovation otherwise to make reduced developments, finding out how restoration funds efforts are crucial to be sure a flaccid and you will effective endeavor.

Just how can Repair Money Performs?

Repair funds is actually borrowing products made to render investment to possess home improvement programs. It enable it to be property owners so you can borrow funds especially for home improvements, enhancements, otherwise solutions. This type of financing vary from conventional mortgage loans, since they are designed to cover the costs regarding renovations or enhancing a current assets. If you’re considering a repair loan, it’s vital to know the way it works while the advantages they promote.

To loans Chuluota locate a restoration loan, it is possible to typically have to go through a lender for example a financial otherwise borrowing from the bank union. The application form processes pertains to taking detailed information regarding the restoration opportunity, including the projected costs and schedule. The financial institution usually assess their eligibility centered on things such as for instance your credit rating, income, while the appraised value of your house.

Immediately after approved, the lender often disburse the borrowed funds amount either in a lump contribution or even in numerous payments, depending on the certain financing terms. You are able to these financing to expend contractors, pick information, and you will defense other recovery expenses. It is vital to keep in mind that money from a repair financing are typically held for the an enthusiastic escrow account and create inside amounts as endeavor progresses. This means the money can be used for the suggested mission and this new home improvements meet certain conditions.

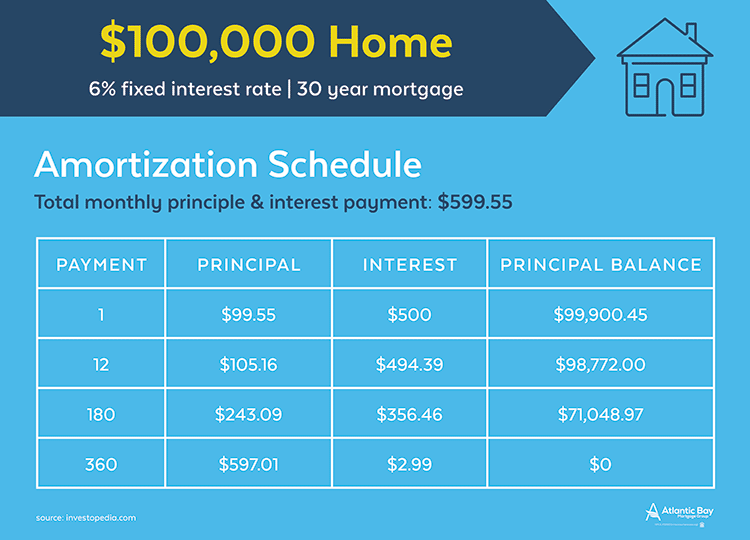

Fees terms and conditions to possess renovation fund vary with regards to the bank and you can the mortgage method of. Specific fund have fixed rates and need monthly obligations more than a designated label, although some may offer flexible cost options. Its necessary to very carefully remark the loan small print, including interest levels, charge, and cost schedules, before recognizing a remodelling mortgage.

Whenever If you Imagine a renovation Mortgage?

Restoration financing shall be a selection for people in numerous points. Here are some problems where to believe applying for a repair mortgage:

step 1. Biggest House Renovations: Should you decide extreme renovations such as for instance including an additional rooms, building work the kitchen, otherwise upgrading the bathroom, a remodelling loan also have the required funds.

2. Place Additions otherwise Expansions: If you like additional liveable space, a renovation loan can help you finance area improvements otherwise expansions, enabling you to create significantly more practical and roomy elements on the household.

3. Called for Repairs: When your assets means very important solutions, such as for example fixing a leaking rooftop, replacement awry plumbing system, otherwise handling architectural products, a restoration financing can help defense these types of can cost you.

cuatro. Energy savings Developments: Restoration money can be used to finance times-efficient updates, such as installing solar power systems, upgrading insulation, or replacement old doors and windows. This type of improvements may help decrease your times expenses and increase the fresh worth of your home.

5. Cosmetic Upgrades: If you want to refresh the appearance of your home that have cosmetics improvements instance the fresh flooring, painting, otherwise landscaping, a renovation mortgage offer the income you need.

Restoration fund give several advantages more than other types away from money, instance credit cards or personal loans. Very first, the interest cost to own repair funds are generally less than those individuals to possess playing cards, making them a very costs-energetic choice. Second, the mortgage amounts designed for renovations are usually higher than what you could get having signature loans. Finally, renovation financing usually have way more flexible cost conditions, enabling you to favor a repayment plan that suits your financial disease.