- #step 1

Fellow member

- #dos

Well-known representative

- #step 3

Webpages Party

Searching to find the new? Money has become problematic for RVs more 5-six years of age and you will 10 years is out of the limit of every Camper financial support class. A substantial downpayment is apparently called for too.

If or not an Rv financing is actually assumable or perhaps not utilizes the brand new lender, so you would need to target you to matter once you select you to you like that has existing financing. To visualize a loan, you have got to buy the actual earlier in the day owner’s equity (or no), with the intention that may imply a down payment also.

Shortage of a credit score is an issue, therefore you should begin strengthening certain credit in the event you want to buy down the road. g. gas for the vehicle) and pay it off whenever due. Generate a reputation.

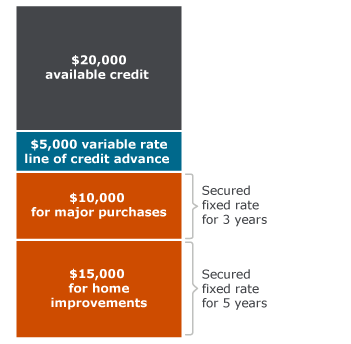

This new idea regarding a property equity credit line is actually good a that as well – consult the lending company(s) you do company with about you to.

- #4

Well-identified member

I concur that a property security range could be a choice or score a lender to just safe a genuine Camper financing resistant to the collateral in your house. You have got a https://availableloan.net/installment-loans-hi/ dual whammy. Managing a business and you can shortage of credit score if you’re spending cash to possess exactly what shows up. If you have solid team financials and tax returns showing the fresh net gain and you will what you are pulling and you may customers draw you shouldn’t have difficulties obtaining credit. What bank would you explore for your business? They need to should help specifically if you consent in order to vehicle deduct to suit your repayments.

- #5

Well-recognized member

Just like the Gary said, capital happens to be more difficult having RV’s because the 2008 and you will 2009. In my opinion this new financial crisis caused a tight money condition to have lenders you to definitely inspired financial support to your property, RV’s or any other big ticket activities. Some of the loan providers you to funded RV’s started simply financial support brand new RV’s simply because they had been becoming more selective.

However, I funded mine due to my regional borrowing from the bank commitment at an extremely low interest rate (a little more than step 3%) last year. New motorhome I got myself is eleven yrs old at the time and i also got it at a high price which was lower than lowest shopping. The credit commitment funded the acquisition 100% plus taxation and registration fees and didn’t want me to spend a deposit. Supplied, I merely financed they more an effective cuatro year name, but they could have complete it to possess eight to a decade on a somewhat highest interest. My personal credit score is over 800 now but was not on the time We funded the latest Rv.

When you’re a person in a credit relationship, was you to route. Otherwise, of a lot borrowing from the bank unions try available to the fresh users today while may indeed register one that is familiar and you will knowledgeable about Rv capital.

- #6

Active member

rv investment will likely be all over the map. together with monetary crises of some in years past provides lenders runnin getting cover.

They told you as the I didn’t own a property (sold many years straight back) along with no reported experience of using high contribution, long term camper build repayments, they could provide to finance an one rv financing. its suggestion was to go get one elsewhere and i also you’ll import the loan on it on a far more sensible rate once i got paid back effortlessly having a-year into the large rates financing.

The fact that We have assets (my personal IRA) that were worth repeatedly the worth of the borrowed funds I try seeking failed to seem to amount both.

I contacted my credit relationship in addition they said they may mortgage myself money in excess of 8.00 per cent, but restriction title are eg 4 age. so it wasn’t attractive for the 60k I became trying loans. the individual towards phone told you, the borrowing from the bank connection got chose not to ever get in this new camper sector (large default/repo rates is actually my personal suppose)

I quickly called my personal financial more than twenty years, Wells Fargo. in spite of an 840 credit history, the best the bank given me is sumptin into the order off 10.5 percent and therefore, in contemporary sector, seemed like highway burglary.

Appeared up several on line “i fincance RVs” folk on the web and try refuted by each subsequently. cannot individual a house was the latest driver when you look at the these instances.

At about the period We discovered an effective equipment I became interested on LaMesa Rv, inside the Tucson, AZ. It hooked myself up with Alliant Borrowing Relationship (1-800-23902829). It grabbed my mortgage instantaneously in the 4.forty two per cent, into a great good 6 yr old advisor, 30k kilometers.

bottom line. the eye from lenders is perhaps all over heck towards camper loans. focusing on good used device thu a giant agent will get you solutions that the very own lender cannot provide you and you may an interest rate nearer to realistic than you may manage to find oneself.

alliant credit connection is actually prolly worthy of a visit. he’s earnestly on the market out-of long term capital RVs both the newest and made use of.